PayTech Explained: The Evolution of Payment Technology

PayTech Explained: The Evolution of Payment Technology

Sadman Sakib Khan

Sadman is a marketing professional and a fervent devotee of the ever-evolving world of marketing & technology. Possessing a knack for crafting compelling narratives, Sadman passionately engages in the creation of top-tier content in close partnership with esteemed subject matter experts.

Imagine this, you’re late for work. You are on the run. You desperately need your morning caffeine. But in the rush, you forgot your wallet. In the past few days, this would be a major bummer, right?

Now, fast forward to today. You forgot your wallet, but you still have your phone or smartwatch with you. Get that out, open that app, and your payment is done. Also, your coffee and muffin are hot and ready to be consumed—no wallet drama. You reach your workplace happy, satisfied, and charged with your daily dose of caffeine.

This is the evolution of payments that we are talking about.

What is PayTech?

PayTech, short for payment technology is the game changer that’s revolutionizing the way we handle money in our day-to-day life. It’s no longer about swiping cards anymore.

It is the powerhouse solely focused on revolutionizing how we make payments and conduct transactions.

PayTech covers everything from mobile payment and contactless transactions to digital wallets and online banking.

This technology revolution is like having a finance wizard at your fingertips.

Think of this, you can now smoothly split bills with your friends, get your morning coffee with some taps, and manage your entire budget from your phone. Like, how convenient is that?

Ever thought about your heartbeat replacing your password? Will we ditch cash for good? Will AI shape our spending habits? Brace yourself for a wallet-free, tech-driven future.

The Historical Journey: Birth of PayTech

It’s ancient times. Swapping goats for grains was the norm. That’s called barter – the OG trade.

From bartering goats to coins – ancient game-changer. Standardized currency made trade a breeze, no more weighing goods.

Moving forward the banks. The unsung heroes of payment evolution. They brought checks debit and credit cards. Make transactions more secure. From paper trails to card swiping, banks paved the way for modern payments.

Then came the digital revolution: ATMs made easy cash, and online banking turned couches into financial hubs.

And, PayTech began with online payments. Freeing us from cash. Then came mobile wallets. The trailblazer? Contactless cards, simplifying transactions. And, you just can’t forget Bitcoin. The rebel of decentralized currencies. Each technological leap marked a milestone, birthing the PayTech. Where convenience meets innovation.

Learn more about Fintech and its subdomains

Key Pillars of Modern PayTech

And, now in today’s world modern PayTech stands on 4 Key Pillars. Let’s start exploring them one by one.

1. Mobile Payments

Mobile payments are the transfer or payment of funds through mobile devices. The transactions typically take place between person to person which is a money transfer, merchant or business for bills, goods and services. The tool can be e-wallets, peer-to-peer payment apps, SIM toolkit/mobile menu.

Mobile payments is one of many Mobile financial services (MFS) that is seen as the gateway for other mobile financial services such as mobile banking, and mobile insurance, mobile credit or lending, investment products, etc.

Mobile payments can happen between person-to-person (P2P), consumer-to-business (C2B), business-to-consumer (B2C), and business-to-business (B2B). A P2P transaction is considered a mobile money transfer (MMT), while all the other commercial transactions C2B, B2C, and B2B strictly resonate with the idea of mobile payments.

Now let’s look at some data to understand the significant growth of mobile payments

Global Transaction Volume:

Regional Share

Sector Impact

2. Biometric Authentication

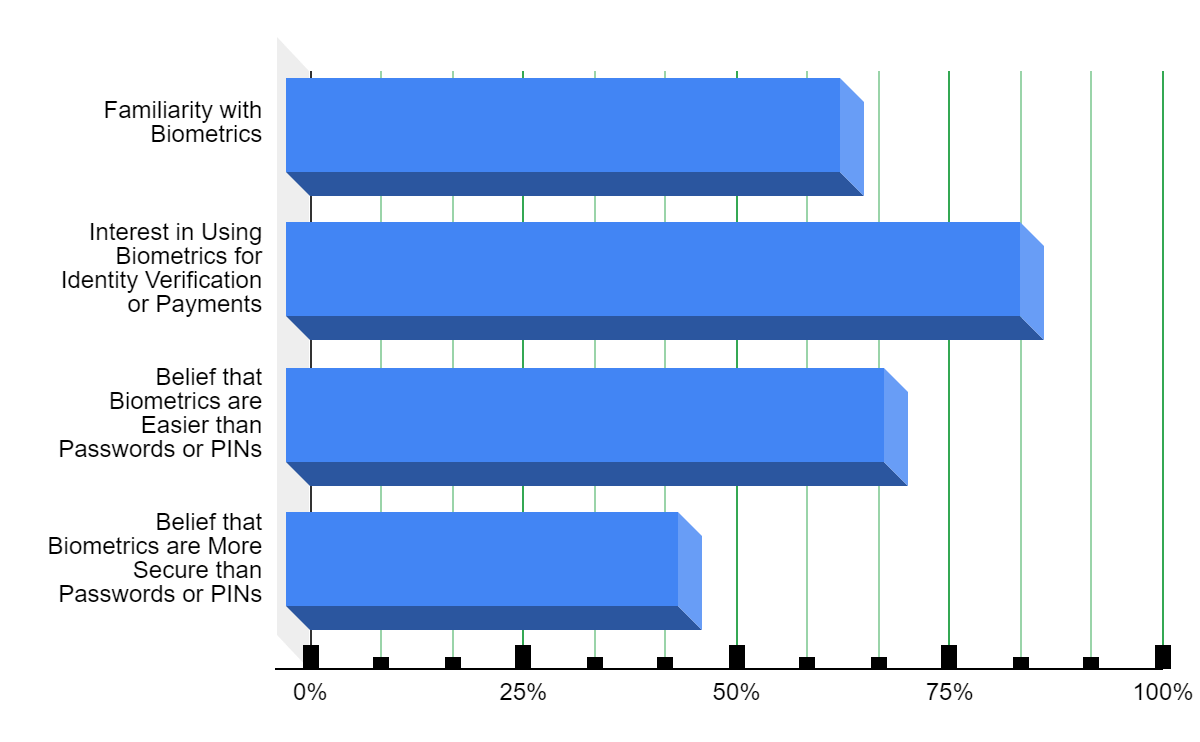

Biometric authentication is the use of a person’s physical characteristics to identify and authorize permission and access. Typically this takes the form of facial scans or fingerprints. Other bio authenticators include iris scan, retina scan, etc.

Bio authentication is crucial, especially for digital financial services. Platforms such as e-wallets, online banking apps, and P2P and other native payment apps store a person’s funds, debit and credit cards. So security is the utmost priority here.

Visa’s survey reveals the numbers of people’s engagements and thoughts on Biometrics Authentication, which is visualized in the following chart

3. Alternative Payment Methods (APMs)

Alternative payment methods or APMs refer to any cashless or cardless methods of transferring funds that fall outside the realm of traditional credit/debit cards and cash that are affiliated with major international schemes.

Some popular examples of APMs include but are limited to:

- Cryptocurrencies: Decentralized digital assets like Bitcoin and Ethereum, facilitating secure and borderless payments.

- Buy Now, Pay Later (BNPL): Financing purchases and spreading the cost over installments, often interest-free.

- Digital wallets: Apple Pay, Google Pay, and Samsung Pay, enabling contactless payments through smartphones or smartwatches.

- Open banking: Sharing financial data with trusted third-party apps to unlock innovative payment solutions.

4. Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing payments. And, the technology has become a crucial part of PayTech for three particular reasons

1. Fraud Detection

- Real-time analysis: Traditional systems often rely on periodic checks, while AI can analyze transactions instantly, flagging suspicious activity before damage is done.

- Pattern recognition: ML algorithms learn from historical data to identify complex patterns indicative of fraud, even in new and evolving tactics.

- Adaptive learning: As fraudsters constantly adapt, AI systems can automatically update and refine their detection methods, staying ahead of the curve.

2. Risk Assessment

- Personalized credit scoring: AI can analyze a broader range of data points beyond traditional credit scores, providing a more accurate and individualized assessment of creditworthiness.

- Dynamic risk management: Real-time adjustments to risk thresholds based on changing market conditions and individual behavior enable flexible and proactive risk mitigation.

- Early warning systems: AI can identify potential financial distress or delinquency risk in advance, allowing for preventative measures and support.

3. Personalized Payment Experiences

- Predictive analytics: AI can anticipate customer needs and preferences, suggesting relevant payment options and tailoring experiences to individual spending habits.

- Frictionless authentication: Facial recognition, voice biometrics, and other AI-powered methods can provide secure and convenient authentication without cumbersome passwords.

- Smart recommendations: AI-driven chatbots and virtual assistants can offer personalized financial advice and guide customers toward optimal payment solutions.

The Benefits of PayTech

There are several benefits of PayTech and for your understanding, we’ve segmented it. Let’s delve in

For Consumers

- Increased convenience: Savoring the convenience of securing your coffee fix even when you forget your wallet at home just got a whole lot simpler.

- Security: Unlike carrying cash, digital wallets keep you secure preventing the possibility of providing a heightened level of security, and mitigating the possibility of unauthorized access. Also, you are less likely to get robbed.

- Automated Payments: Automating your recurring monthly payments, for instance, Netflix bill sounds interesting, right?

For Businesses

- Streamlined transactions: Bye manual work, hello faster settlements & global reach.

- Reduced costs: Lower fees, less paperwork, better control.

- Enhanced customer experience: More payment options, frictionless checkout, and personalized touch.

- New revenue opportunities: Subscriptions, data insights, embedded finance.

For The Economy

- Increased efficiency: Faster payments, and smoother transactions equal to a more efficient economy.

- Financial inclusion: PayTech unlocks financial access for underserved communities, fueling economic participation and growth. It’s all about inclusion and empowering everyone.

- Potential for economic growth: More money flowing, less friction, equal to bigger economic pie. PayTech fuels innovation, entrepreneurship, and ultimately, a thriving economy.

PayTech isn’t just about convenience, it’s about building a stronger, more inclusive, and dynamic future for all

Paytech Case Studies

PayTech is transforming economies worldwide, bringing greater efficiency, inclusivity, and growth. Let’s delve into success stories from six diverse markets:

Bangladesh: bKash

Challenge: Financial exclusion plaguing rural communities.

Solution: Mobile Financial Service platform enabling cashless transactions and micro-payments.

Impact: Over 60 million users, driving financial inclusion and economic activity in rural areas.

India: Paytm

Challenge: Limited access to financial services and complex payment systems.

Solution: Unified payments platform offering mobile wallets, QR code payments, and online transactions.

Impact: Over 300 million users, promoting cashless transactions and boosting the digital economy.

UAE: Wio Bank

Challenge: Traditional banking systems do not cater to the needs of gig workers and freelancers.

Solution: Digital bank offering personalized financial services and instant account opening.

Impact: Empowering the gig economy and promoting financial inclusion for non-traditional workforces.

USA: Stripe

Challenge: Complexities and high fees hinder online businesses.

Solution: Payment processing platform enabling seamless online transactions for businesses of all sizes.

Impact: Millions of businesses are empowered, driving e-commerce growth and simplifying online payments.

Japan: Line Pay

Challenge: Cash-reliant society with limited adoption of digital payments.

Solution: Mobile wallet integrated with a popular messaging app, offering convenient peer-to-peer payments and in-store transactions.

Impact: Over 80 million users, encouraging cashless adoption and boosting digital transactions.

Europe: Klarna

Challenge: Traditional credit card systems with high fees and rigid borrowing options.

Solution: Buy Now, Pay Later (BNPL) platform allows customers to spread purchase costs over installments without interest.

Impact: Over 40 million users across Europe and North America, democratizing access to credit and boosting online shopping convenience.

PayTech Challenges and Considerations

PayTech's Power, Privacy's Paradox?

PayTech is super-charging our wallets, but with every tap and swipe comes a shadow: data privacy.

The worries:

- Breaches can expose financial data like bank accounts and spending habits.

- Hackers could disrupt transactions and steal money.

- Algorithms might analyze spending to manipulate pricing or target ads.

So, what can we do?

- Strong security: PayTech companies need top-notch encryption and authentication systems to keep data safe.

- Privacy controls: Customers deserve choices about how their data is used, stored, and shared.

- Regulation and oversight: Proper rules and enforcement are crucial to protect everyone.

- Remember, convenience shouldn’t come at the cost of privacy.

PayTech's Hustle: Rules Keep Shifting, But Innovation Won't Stop!

- New tech, new rules: PayTech’s booming, but governments are playing catch-up with regulations, creating uncertainty and complexity.

- Global map of confusion: Different rules everywhere! Expanding can be a logistical nightmare.

- Data privacy tango: Protecting user data is crucial, but rules can be tricky. Finding the right balance is a delicate dance.

- Innovation vs. safety: Regulators want to protect us, but too strict rules can stifle progress.

For PayTechs:

Stay informed: Keep updated on changing rules and play by the book.

Be transparent: Build trust with users and regulators by being upfront about your data practices.

Work together: Collaborate with policymakers to shape fair rules that encourage innovation.

PayTech's Inclusion Challenge: Not Everyone's in the Game!

- Tech divide: Smartphones? Internet? Not everyone has them, making PayTech a tricky board game.

- Cost hurdle: Data plans, fees – it adds up, blocking low-income players from joining.

- Trust issues: Past bad experiences make some wary of new financial moves.

- One-size-fits-all flop: Different cultures, needs – PayTech needs diverse solutions, not just copies.

Winning move?

- Low-tech options: Feature phones, offline features, local languages – bring everyone to the table!

- Affordable access: Partner with others to make data and devices cheaper.

- Trust builder: Transparency, education, community – earn that green light!

- Local heroes: Work with those who know the game and can guide others.

PayTech and the Work Shuffle: Robots Won't Steal Your Job, but They Might Change It

PayTech is shaking things up, and not everyone’s dancing with joy. The worry? Job displacement: will robots and algorithms leave us all jobless? Not so fast! Here’s the lowdown:

- Automation wave: Some tasks, like data entry or simple calculations, might get automated. But remember, robots aren’t good at everything! Creativity, critical thinking, and human interaction are still irreplaceable.

- Job shuffle, not job steal: Instead of mass unemployment, we might see a shift in types of jobs. Think less repetitive stuff, more innovation, problem-solving, and managing the robots themselves.

- Upskilling tango: To stay ahead of the curve, workers need to keep learning new skills. It’s like training for a new dance move every day! Coding, data analysis, and customer service with a digital twist will be valuable.

So, what does this mean for you?

- Embrace lifelong learning: Keep your skills sharp and be open to new challenges. Think of it as adding new steps to your repertoire!

- Focus on your human superpowers: Creativity, empathy, critical thinking – these are what make you unique and irreplaceable.

- Team up with tech: Don’t fear the robots, learn to work with them! They can be your assistants, freeing you to focus on what you do best.

The Future Of PayTech: What’s Next?

PayTech is transforming economies worldwide, bringing greater efficiency, inclusivity, and growth. Let’s delve into success stories from six diverse markets:

Buckle up, because PayTech is about to take a wild ride in the future!

Embedded Finance: Imagine buying groceries straight from your smart fridge. Sound crazy right? That’s embedded finance: seamless financial services woven into everyday experiences. And, by 20023, it’s expected to be a $7 trillion market, according to Juniper Research (October 2022).

Metaverse: A place where virtual worlds hold virtual economies. And, PayTech will power those economies! It won’t be just about games anymore – the metaverse is where we’ll work, shop and yes, even spend money.

Quantum computing: Super-powered computers that could crack current encryption methods, but don’t panic! They’ll also pave the way for unbreakable new security protocols, making online payments even safer.

Fraud Foiled in Real-Time: Imagine AI analyzing transactions as they happen, spotting anomalies faster than the blink of an eye. The global fraud detection and prevention market will reach $57.6 billion by 2027! (Source: Juniper Research, “Fraud Detection and Prevention Market: Global Forecast 2023-2027” (October 2023)).

Credit Score 2.0: Picture algorithms analyzing your online shopping habits, social media presence, and even smartphone data to paint a more accurate picture of your financial responsibility. It might sound intrusive, but Capgemini Research Institute estimates this could result in 47 million additional people gaining access to credit! (Source: Capgemini Research Institute, “AI-Powered Credit Scoring: A Path to Inclusion?” (September 2023)).

Learn More About LendTech The Future of Lending

Hyper-Personalized Payments: AI will curate personalized offers, recommend payment plans based on your spending patterns, and even predict your financial needs before you do. By 2025, McKinsey & Company expects personalization to drive a 10-15% increase in retail sales! (Source: McKinsey & Company, “Personalization: Redefining the Customer Experience” (December 2022)).

PayTech is painting a future where money hums like magic, secure & smooth for everyone. Inclusivity blooms, unbanked empowered, fraud chased away by AI. Your wallet learns, adapts, and becomes a genie, crafting personalized financial wishes.

Wrapping up

We’ve gone from goat swaps to tap and pay, and PayTech’s just getting warmed up. It’s not just about speed, it’s about inclusion, security, and a future where your wallet’s a genie. Challenges whisper, but so do possibilities. Embrace the change, upskill your game, and join the digital wallet revolution. The future’s promising, let’s pay for it!

Tags : fintech, payment technology, Paytech, Paytech explained