RegTech Explained: Understanding the Basics and Beyond

RegTech Explained: Understanding the Basics and Beyond

Sadman Sakib Khan

Sadman is a marketing professional and a fervent devotee of the ever-evolving world of marketing & technology. Possessing a knack for crafting compelling narratives, Sadman passionately engages in the creation of top-tier content in close partnership with esteemed subject matter experts.

A statement of the Boston Consulting Group reveals that financial institutions around the world paid a formidable toll—over $321 billion in fines since the tumultuous year of 2008.

There were vast changes in how businesses approach regulations because of the aftermath of this global financial meltdown. To keep pace with the intricacies of the regulatory world, companies are turning to innovative solutions like RegTech.

RegTech explained in this post. After reading it, you will understand how RegTech is turning the page towards a brighter future in regulatory compliance.

RegTech Explained: A Brief Overview of This Technology

In the aftermath of the 2008 financial crisis, the banking and financial sectors experienced massive changes. Traditional institutions were drowning in the rising tides of regulatory complexities and escalating costs. RegTech was their lifeline.

RegTech is the short form of Regulatory Technology. In 2015, the UK’s Financial Conduct Authority (FCA) first used this term. According to their statement –

Unlike its sibling, fintech, RegTech had a specific mission – to provide innovative solutions for banks and financial institutions. These solutions are designed to handle regulatory requirements. RegTech brought forth a comprehensive view of financial information. It simplified the complexities of data management.

Core Features and Toolkits of RegTech Solutions

Agility is supreme for RegTech. It focuses on Extract, Transform, and Load (ETL) technologies to understand and organize messy datasets. With agility, RegTech enables swift adaptation to ever-changing regulations in finance.

Integration is another key player in the RegTech ensemble. RegTech solutions can effortlessly integrate into existing systems. They ensure a quick setup that won’t leave you waiting in the wings.

RegTech leverages various analytics tools for intelligent mining. It sifts through mountains of information and extracts valuable insights like a skilled prospector striking gold. This feature is crucial in a world drowning in data.

RegTech can work at lightning speed. It can configure and generate reports in a blink. This feature expedites the decision-making process. RegTech ensures you stay ahead of the curve.

Exploring RegTech's Toolkit

RegTech is not a one-size-fits-all solution; it is a toolkit catering to specific needs. Here is a glimpse into its arsenal:

- Activity Monitoring Tools: Good for keeping a watchful eye on operations to identify irregularities.

- Regulation Gap Analysis Tools: Detect gaps in compliance and provide a roadmap for improvements.

- Transaction Reporting Tools: Streamline the reporting process and ensure accuracy and timeliness.

- Case Management Tools: Organize and manage compliance cases efficiently.

How RegTech Differs from Traditional Regulatory Compliance Methods

RegTech was invented to solve complexities for financial institutes. At first, it may sound similar to traditional regulatory compliance methods. The difference is that RegTech uses technology, whereas traditional methods don’t.

Let’s demystify how RegTech surpasses traditional regulatory compliance methods.

- Agility Unleashed: Often, traditional compliance methods resemble rigid giants. They are slow to adapt to changes and demand specific languages for modifications. In contrast, RegTech is swiftly maneuvering through the evolving regulatory landscape. It adapts to new techniques and analytics quickly.

- Modular Marvel: Traditional solutions tend to come with hefty price tags. Plus, they go through lengthy lead times for changes. RegTech, on the other hand, embraces a modular approach. To unlock the full potential of RegTech, multiple plugins or modules can be seamlessly integrated into the preferred platform.

- Cloud-Powered: RegTech truly shines by supporting a cloud-based infrastructure. It means remote maintenance, management, and backup of data. RegTech eliminates the shackles of physical constraints. While traditional methods may struggle with on-premise limitations, RegTech gracefully soars in the cloud.

The Areas Where Implementing RegTech is Useful

RegTech goes beyond just providing solutions for specific problems. It has expanded its usage in different sectors, mostly related to baking and financing. Therefore, different types of users have been using it.

Here are the primary users of RegTech:

- Compliance Officers: The guardians of regulatory adherence find solace in RegTech’s agility and efficiency.

- Risk Managers: For those struggling with risk management, RegTech provides a sturdy solution.

- Finance Professionals: Dealing with quant-based obligations and regulatory reporting is normal for finance professionals. RegTech has become a reliable solution for them.

There are businesses in Bangladesh that are engaged in international trade. These businesses often face a web of regulations. Here, RegTech’s universal compliance tools prove invaluable. It provides a unified platform to adhere to various international and local regulations. This results in smoother cross-border transactions.

Although not widely adopted, banks in Bangladesh can smoothly dodge the regulatory landscape through RegTech. They can ensure accurate and timely submissions. This can reduce the burden on compliance officers.

The thriving corporate sector in Bangladesh also needs health check tools powered by RegTech. It can be a great way to assess the compliance health of businesses. This is particularly beneficial for companies in Bangladesh aiming for sustainable growth.

Advantages and Challenges of RegTech

RegTech came into light to provide a certain number of benefits. This technology is continuously helping many companies around the world to get rid of regulatory complexities. However, it has some limitations since it is not a full-fledged technology yet.

Let’s shed light on the advantages and challenges of RegTech:

Advantages of RegTech

- Improved Customer Experiences:

RegTech solutions reduce onboarding times and enhance consumer experiences. For instance, sanctions screening solutions trim down false positives. They foster the onboarding process.

- Enhanced Regulatory Reporting:

Thanks to big data analytics and real-time reporting, RegTech makes regulatory reporting a breeze. It ensures financial institutions stay in tune with the latest guidelines.

- Better Governance and Data Insights:

RegTech brings order to the data chaos. It extracts and structures information for insightful governance. With its expertise, it transforms data into a valuable asset. In addition, it provides useful insights for decision-makers.

- Effective Risk Management:

RegTech solutions are like vigilant guardians. They detect regulatory risks, evaluate associated risks, and even foresee future threats. Therefore, institutions can easily tackle challenges with this proactive risk management.

- Market Stability Boost:

RegTech can significantly reduce fines paid by financial institutions. This not only benefits the institutions but also stimulates the broader economy. Thus, RegTech plays a role in improving market stability.

Challenges of RegTech

- Skill Set and Knowledge Hurdles:

Building a RegTech solution requires specific technological skills. It also needs extensive domain-specific knowledge. The challenge lies in finding and retaining individuals with this unique skill set.

- Perception of Compliance:

Many financial institutions view compliance as a burden rather than a business opportunity. Shifting this perception is crucial. While technological advancements often focus on revenue-generating activities, they hardly recognize the efficiency-driving potential of RegTech.

- Departmental Silos:

Financial institutions often operate in silos. Each department works independently. However, RegTech implementation requires a collaborative effort from various departments. Breaking down these silos can be a significant challenge.

- Data Uniformity Challenges:

Besides working independently, different departments use diverse data formats. RegTech solutions won’t read and process information effectively due to the lack of uniformity in data. This stumbling block can limit their capabilities.

- Scattered Processes and Regulatory Obligations:

In larger institutions, processes are scattered across locations. Each area needs to comply with local regulations. Scaling up and meeting all these regulatory obligations poses a serious concern for implementing RegTech.

Future Trends and Innovations We Expect in RegTech

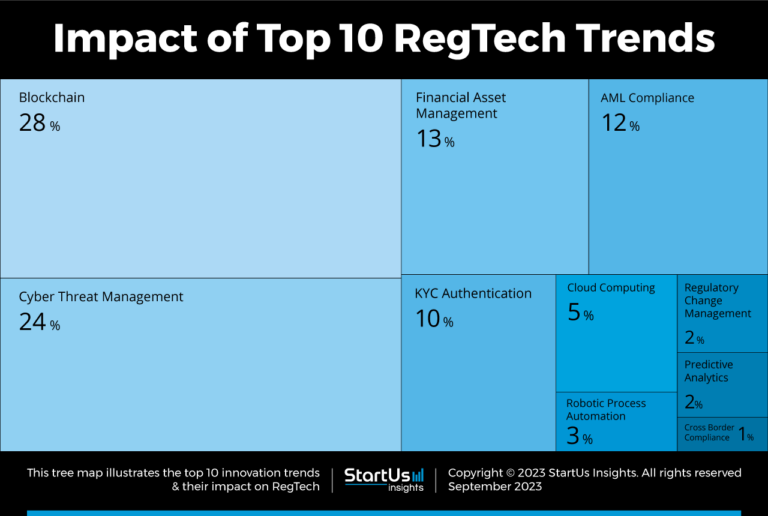

Are you asking yourself, “What is the future of RegTech?” To find the answer, you must analyze the upcoming trends and innovations for RegTech. The following trends of RegTech will likely reshape the regulatory landscape.

1. Blockchain:

Emerging companies want to monitor and validate transactions automatically. So, they are integrating blockchain solutions. These solutions prevent financial crimes and enhance regulatory adherence.

2. Financial Asset Management:

The future sees a transformation in financial asset management. Currently, companies are integrating big data, analytics, cloud computing, and blockchain. This is how they find customizable platforms that navigate intricate regulatory frameworks.

3. AML Compliance:

Anti-money laundering (AML) regulations pose challenges for financial institutions. Startups leverage AML tracking solutions for various reasons. These include monitoring transaction behavior, detecting fraudulent patterns, and ensuring compliance.

4. Cyber Threat Management:

The rising threat of cyber-attacks demands innovative solutions. RegTech can tackle this menace. It incorporates AI, machine learning, and blockchain for this purpose.

5. KYC Authentication:

Know-your-customer (KYC) authentication collaborates with advanced AI-driven solutions. Biometric recognition, natural language processing (NLP), and machine learning accelerate workflows.

6. Cloud Computing:

The cloud becomes a powerhouse for scalable infrastructure. In this case, startups can offer innovative solutions for swift regulatory adaptation. They comply with optimized cost management.

7. Robotic Process Automation (RPA):

With the integration of AI and ML, RPA enables intelligent process automation. It can create a virtual workforce that learns from data sets. It reduces human errors and ensures consistent compliance.

8. Regulatory Change Management (RCM):

Maintaining compliance with newly introduced regulations is a multi-step process. It prevents organizations from drowning in the volume and speed of these changes.

9. Predictive Analytics:

Say goodbye to time-consuming models. Predictive analytics uses statistical algorithms, predictive modeling, and machine learning. Therefore, startups can identify potential compliance issues in real time.

10. Cross-Border Compliance:

Businesses are using technologies like AI, ML, and data analytics. This is how they are creating a harmonized regulatory framework across diverse jurisdictions. At the same time, they are reducing compliance risks in making international payments.

Wrapping Up

RegTech is a symphony of agility, integration, analytics, and speed. As the regulatory landscape evolves, RegTech remains at the forefront. It will always remain a transformative force. Hopefully, the complexities of this technological narrative become clearer—RegTech explained.

Businesses noticed reductions in compliance costs and a renewed sense of market stability. They are reaping the benefits of RegTech. Undoubtedly, we will see a brighter and more efficient future in this technology.

Tags : fintech, Regtech, Regtech explained, regulatory technology