AI in Insurance: How Insuretech is Changing the Claims Process

AI in Insurance: How Insuretech is Changing the Claims Process

Sadman Sakib Khan

Sadman is a marketing professional and a fervent devotee of the ever-evolving world of marketing & technology. Possessing a knack for crafting compelling narratives, Sadman passionately engages in the creation of top-tier content in close partnership with esteemed subject matter experts.

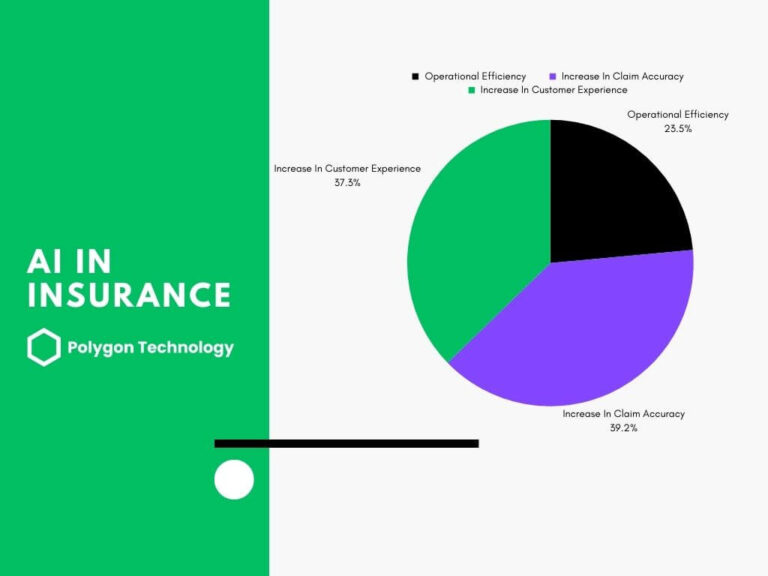

In the insurance industry, operational efficiency has risen by 60%. Plus, there has been a noteworthy 99.99% increase in claim accuracy. Moreover, the industry has seen a 95% increase in customer experience. So, it is clear that the emergence of AI in insurance is reshaping the industry at an unprecedented pace.

Forbes declared that AI in insurance will reach USD 35.77 billion by 2030, with a remarkable CAGR of 33.06%.

Today, we will discover numerous roles and applications of AI in insurance. Let’s uncover its benefits & real-world use cases. Finally, we will look at the current trends in AI that are driving the insurance industry.

What Do We Understand by AI in Insurance?

AI in the insurance sector has ushered in an era of automation. Fundamentally, it altered how we perceive and interact with insurance providers. Gone are the days of skepticism and prolonged processes. Instead, AI is enhancing efficiency and reducing the traditional hassles associated with insurance.

So, how exactly is AI reshaping the insurance domain for both businesses and policyholders?

First of all, insurers now use advanced tools to assess risks, detect fraudulent activities, and minimize human errors. This proactive approach safeguards the interests of insurance companies. Additionally, it contributes to an overall reduction in risks and fraudulent claims.

Secondly, the integration of AI streamlined customer services and expedited claim processing. Therefore, interactions with insurance providers become easier and more customer-friendly. The days of cumbersome and time-consuming procedures are gradually fading away. This shift is partially establishing a new benchmark for the industry’s responsiveness.

Traditionally, the underwriting process was a complex affair. It required substantial human intervention. This process has become more efficient and accurate, thanks to the disruptive force of AI. Now, insurance policies are created according to individual needs while minimizing the potential for errors.

Furthermore, underwriters can gauge risks more comprehensively because of the adoption of AI and Machine Learning (ML) in insurance. Now, they can provide more customized and competitive premium pricing. It benefits policyholders by providing a more personalized experience.

What Benefits Can AI Bring to the Insurance Sector?

The insurance sector is ever-evolving. To stay ahead in this sector, insurers and policyholders need to be familiar with cutting-edge technologies. These include machine learning, blockchain, metaverse, robotic process automation, and more.

These technologies bring tangible benefits to the tedious and exhaustive processes within the insurance industry. Let’s discover some of the remarkable advantages that AI adoption can deliver.

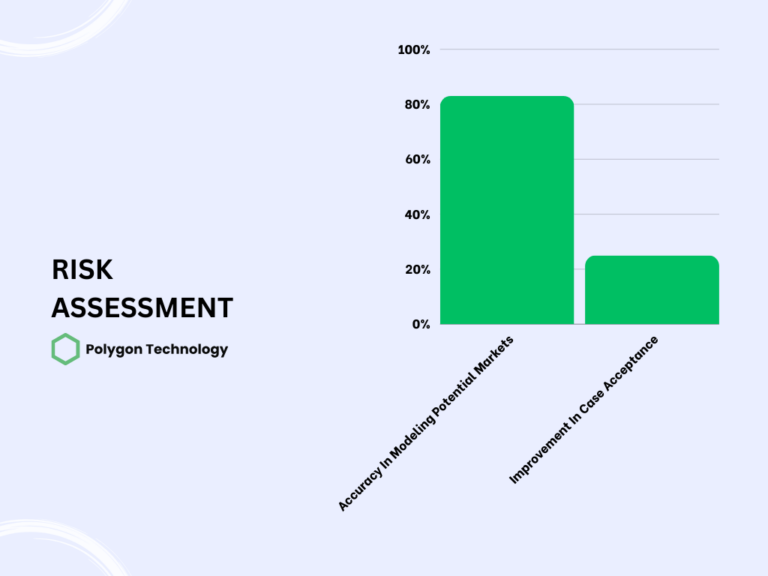

Risk Assessment:

Historically, underwriting heavily relied on manually provided data. It often left room for inaccuracies and dishonesty. AI, along with IoT devices and Natural Language Processing (NLP), fetches larger datasets with accurate information.

Streamlined Claim Processing:

Processing insurance claims is notoriously complex. Agents have to go through various policies with meticulous attention. AI steps in to automate these tasks. It minimized errors and significantly reduced the time it takes to process claims.

Insurers are integrating technologies like AI, RPA, and IoT. As a result, they can collect data from smart home assistants, fitness trackers, and healthcare wearables. It facilitates better connectivity with policyholders.

Effortless Claims Reporting:

AI in insurance claims simplifies the first notice of loss. It enables efficient reporting, routing, triaging, and assignment of claims. Chatbots play a crucial role in facilitating this process. Therefore, customers can report incidents from any device, at any place, and at any time.

Detecting & Preventing Fraud:

The insurance industry handles around $1 trillion in premiums annually. So, the risk of fraud is significant. AI can analyze massive datasets to identify suspicious patterns in real-time. Hence, it has become a game-changer in detecting and preventing fraud. Ultimately, it protects policyholders from fraudulent claims.

Manage and Investigate Insurance Claims:

Effortless operations are possible after integrating AI and ML into insurance processes. It saves both time and costs associated with various insurance operations. Also, it enhances insurance claims management and investigation.

Accuracy in Estimating Loss:

AI’s latest advancements simplify damage assessment. In this context, machine learning, deep learning, and OCR play a vital role. The extent of damage can be quickly and efficiently determined by uploading a picture of the damaged object.

Improved Routine Operations:

AI-powered chatbots revolutionize customer service in the insurance industry. These chatbots initiate and disseminate information without human intervention. They automate repetitive tasks. Therefore, human resources can spend more time on strategic roles.

4 AI-driven Trends and Innovations Changing the Insurance Industry

The insurance industry is transforming. This transformation is fueled by the integration of Artificial Intelligence (AI). Mainly, the following 4 AI-driven trends and innovations are responsible for this.

01. Data Explosion from Linked Devices

The rise of connected consumer devices, spanning cars, fitness trackers, home assistants, smartphones, and more, is set to explode in the coming years. Experts predict up to one trillion connected devices by 2025. Hence, insurers will get unprecedented insights into their clients.

With this vast amount of information, insurance carriers can dig deeper into understanding customer behavior. This will lead to the innovation of new product categories. Consequently, the industry will come up with highly personalized pricing models. Plus, there will be a shift towards real-time service delivery.

02. Increased Prevalence of Physical Robotics

The field of robotics is evolving rapidly. This evolution is impacting how humans interact with the world. Additive manufacturing, or 3D printing, is poised to revolutionize construction. Hopefully, 3D-printed buildings will become commonplace by 2025.

Autonomous drones, farming equipment, and advanced surgical robots are on the horizon. It is only normal to expect a higher prevalence of autonomous features in standard vehicles by 2030. So, insurers must adapt to assess the risks associated with these technological advances.

03. Data Ecosystems and Open-Source

As data becomes omnipresent, open-source protocols are facilitating data sharing across industries. Collaborative efforts between public and private entities are creating ecosystems. Here, data can be shared under common regulatory and cybersecurity frameworks.

For instance, wearable data could directly benefit insurance carriers. On top of that, connected home and auto data could be accessible through major platforms. These are Google, Amazon, Apple, and various consumer device manufacturers. This interconnected dataset is fostering collaboration and innovation in the insurance sector.

04. Progress in Cognitive Technologies

Initially, convolutional neural networks and deep learning were applied to image, voice, and unstructured text processing. However, these cognitive technologies are evolving to handle diverse applications.

A standard approach would be to combine these technologies with the learning capabilities of the human brain. This will be effective for processing vast and complex data streams generated by “active” insurance products. Plus, we need to commercialize these cognitive technologies. Doing so will grant insurers access to models that continuously learn and adapt in real time.

AI in Insurance Use Cases

The strides of AI are revolutionizing the insurance industry. Several companies are actively utilizing its power. On that note, let’s explore some real-world AI in insurance use cases.

ZestFinance:

This company is a trailblazer in using AI to transform how lenders assess risk. Using AI, it receives data from both traditional and non-traditional sources. Plus, it uses AI to automate the underwriting process. As a result, it can provide lenders with a more accurate risk evaluation.

Lenders are making profits from this strategic approach. Additionally, it minimizes the risks associated with loan approvals. ZestFinance is a great example of using AI to streamline complex tasks. The company is making financial assessments more precise and efficient.

Lemonade:

This is an InsurTech startup. It has integrated AI technology into its end-to-end insurance operations. This strategic use of AI has allowed Lemonade to achieve operational efficiency. This is how the company is saving a lot of money.

Speaking of the ripple effect, the company can offer insurance policies at reduced prices. It enhances customer acquisition efforts and elevates the overall customer experience. Lemonade’s success demonstrates how AI can optimize various aspects of the insurance process.

Metromile:

By leveraging telematics and AI technologies, this company stands out as an insurance provider. To be precise, it has become a pioneer of pay-per-mile auto insurance.

Through a device installed in vehicles, Metromile collects data on mileage, speed, and driving habits. AI algorithms then analyze this data to generate personalized insurance premiums. This creative method matches insurance premiums to specific driving habits. This results in a more equitable and efficient insurance model.

Metromile is an example of how AI and telematics can transform conventional insurance models.

Read More About InsureTech: InsureTech Explained: Innovations Redefining Insurance

Conclusion

AI in insurance will usher in rapid technological advances. New technologies are necessary to forge innovative products, extract cognitive insights from novel data sources, streamline processes to cut costs, and surpass customer expectations through dynamic adaptation. The ultimate winners will be the carriers who leverage them.

The constant evolution of AI will shape the future of insurance. To strike a balance between tradition and innovation, insurers must dare to pioneer new frontiers in AI.

Tags : ai in insurance, fintech, insuretech