10 Reasons Why LendTech is Important for Banks, Lenders, & Financial Institutions

10 Reasons Why LendTech is Important for Banks, Lenders, & Financial Institutions

Sadman Sakib Khan

Sadman is a marketing professional and a fervent devotee of the ever-evolving world of marketing & technology. Possessing a knack for crafting compelling narratives, Sadman passionately engages in the creation of top-tier content in close partnership with esteemed subject matter experts.

Estimated global LendTech revenue grew 15% annually between 2022 and 2028, exceeding the overall banking industry’s growth rate of 6%. This translates to a potential 300% increase in revenue over 5 years. This rise indicates a seismic shift in how financial services are delivered and received. (Source: McKinsey & Company)

But what exactly is LendTech, and why is it important? LendTech is short for lending technology. It is important for plenty of reasons. Personalized lending experiences, lightning-fast decision-making, streamlining the loan process, and accessing credit scores accurately are some of the compelling ones.

In this post, you’ll discover 10 reasons why Lendtech is important for banks, financial institutions and the rapidly growing world of fintech.

Why LendTech is Important for Financing and Lending: 10 Compelling Facts

In the financial sector, LendTech is one of the growing sectors of innovation. But how is it growing so quickly?

To find that answer, you must go through the following 10 reasons.

1. Democratizing Access to Credit:

In the traditional banking system, some people are left out unintentionally. LendTech is coming up with innovative ways to tap into this untouched market. Often, it operates online or through mobile apps. So, individuals in remote or underserved areas can access financial services. LenTech considers a wider range of factors beyond traditional credit scores. It uses alternative data sources like your online behavior, social media activity, or even utility payments. So, it can easily assess your creditworthiness. Moreover, LendTech is also using micro-lending to make a positive impact. These small loans are helping people start businesses, pay for education, or cover unexpected expenses. They benefit those who might not need a large sum but still face financial challenges.2. Streamlining the Loan Process:

Traditionally, getting a loan meant a pile of paperwork, and endless waiting. It was a time-consuming process that required numerous visits to a bank. LendTech has flipped the script by making everything digital.

Thanks to LendTech, you can apply for a loan using a computer or a smartphone. No more paperwork or waiting in line — it is all done online. LenTech utilizes automation and artificial intelligence (AI) to make faster and more accurate decisions.

Just imagine a computer quickly analyzing your financial data and giving a thumbs up for a loan in minutes. That’s the power of LendTech. It is all about making things easier for you. No need to make multiple trips to a bank or wait for weeks just to get an answer.

3. Enhanced Risk Management and Fraud Detection:

LendTech relies heavily on big data. By analyzing a massive amount of data, it predicts the risk associated with lending. This data may include your financial history, spending patterns, and even online behavior.

This is how they build a more accurate and comprehensive risk profile for each borrower. Plus, they use advanced analytics and machine learning for credit scoring. Means a more accurate assessment of someone’s creditworthiness.

This improved credit scoring benefits both lenders and borrowers. For lenders, it minimizes the risk of defaults. So, they can make more informed lending decisions. For borrowers, it can lead to better interest rates and terms. On a broader scale, these advancements in risk management contribute to a more stable lending ecosystem.

4. Personalized Lending and Customer-Centric Approach:

LendTech platforms go beyond the one-size-fits-all approach. They use technology to understand your unique financial situation, goals, and needs. As a result, you will get tailored loan options and interest rates.

For instance, if you have a strong credit history, you might get a lower interest rate. On the other hand, if you are just starting to build credit, LendTech platforms may offer suitable options according to your current financial standing.

LendTech platforms are moving away from the transactional model. By understanding your financial status and providing personalized solutions, they aim to be your go-to financial partner.

5. Driving Efficiency and Cost Reduction:

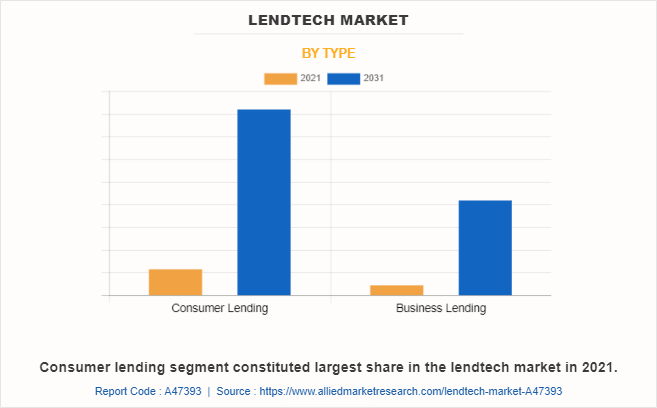

In 2021, the global market for lendtech was estimated to be worth $8 billion. By 2031, it is anticipated to reach $61.9 billion.

Using advanced technology, LendTech can eliminate manual, time-consuming processes. It can reduce the need for human intervention. So, LendTech can speed up the loan approval process (as said earlier). As well as, cutting down operational costs by streamlining workflows.

As it’s cloud-based, It stores data and runs operations in the cloud. Therefore, information becomes accessible from anywhere, anytime. So, LendTech increases flexibility. Plus, it reduces the need for expensive on-premises infrastructure.

LendTech can directly improve profitability. Allowing organizations to utilize Staff more effectively & lower overhead costs. So they can offer more competitive interest rates and terms to borrowers.

6. Detailed Customer Data Using AI and ML:

When it comes to understanding a borrower’s financial story, LendTech works like a smart detective. It just doesn’t look at traditional things like credit scores and income. Instead, it uses Artificial Intelligence (AI) and Machine Learning (ML) to dig deeper.

AI and ML analyze relevant information about you. This is how LendTech easily creates a detailed picture of your financial situation with a 98% precision rate!

It is crucial to learn and adapt to new patterns of fraudulent activity for LendTech. Therefore, it continuously deploys machine learning algorithms. These algorithms can identify anomalies and flag potentially fraudulent applications in real time.

For example, if there is an application that doesn’t align with typical borrower behavior or if certain data points seem suspicious, machine learning will quickly raise red flags. Hence, LendTech can prevent fraud before it happens.

7. Access to Advanced Analytics:

LendTech is like the smart brain behind lending; helping lenders to make informed decisions with the help of advanced analytics. LendTech offers tools to track weekly, monthly, quarterly, and even annual loan applications. Therefore, lending institutions understand when people need loans the most.

In addition, analytics dive deep into understanding who’s applying for loans. It looks at their locations, credit scores, and other details. Lenders know their customers better through this analytical data.

On top of that, analytics can predict how different factors affect loans. It can tell if someone is having trouble paying back a loan. This is crucial information! It helps lenders decide things like, “Should we make it easier for people to get loans?” or “Do we need to be more careful to avoid risks?”

8. Eliminates Paperwork Associated with Manual Processes:

LendTech banishes paperwork from the loan process. Gone are the days when you needed to fill out endless forms or shuffle through stacks of documents. Now information can be gathered quickly online.

Guess what? You don’t have to worry about someone deciphering your handwriting. LendTech syncs up with credit bureaus and other banks to check all the info you have submitted. It is a super-smart assistant that double-checks everything for you.

Because there is no paperwork chaos, you save a ton of time. LendTech makes sure you are not stuck in a paperwork maze. And the best part? It uses smart algorithms & artificial intelligence to figure out the risk of your loan application. So, you can have a more relaxed and happier experience.

9. Accessible from Different Devices:

It’s like having a bank in your pocket. You can access it from your computer and smartphone. When you think, “Hey, I need a loan,” LendTech makes it possible. Just grab your smartphone, open the app, and start the loan process. It is similar to ordering pizza with just a few taps – super convenient!

If you start your loan application on your laptop but decide to switch to your phone, LendTech lets you do that. It makes sure everything, from applying for a loan to getting it approved, is as easy as posting a picture on social media.

Today, convenience is the name of the game. Understanding that if things are not easy and quick, people might just go to another lender. That is why LendTech market is expanding its global market share.

10. Swiftness in Decision Making:

One of the coolest things about LendTech is its speed in processing loan applications. When you send in your application digitally, along with any needed files, the whole process becomes lightning-fast. This is a prime cause of LendTech’s 23.2% CAGR from 2022 to 2031.

Behind the scenes, there are these things called workflows. They guide the underwriting process. It takes less than a minute for the system to look at your application details and figure out if you are good to go. LendTech platforms use automated calls to tap into alternative credit data sources.

But the speed doesn’t stop there. LendTech is so quick that it can often respond to your application within seconds. Yes, seconds! It sends you e-contract offers through emails in a flash. And with e-signatures, you can seal the deal instantly. With LendTech, you can make financial decisions quicker than you can say “Loan approved!”

Final Words

The above 10 reasons make LendTech the catalyst for a financial revolution. They indicate how LendTech is reshaping the lending industry. LendTech can present an agile and responsive lending process. It is attuned to the needs of the modern borrower.

The importance of LendTech is not confined to technology. It extends into the heart of financial inclusion and empowerment. No doubt, it has become indispensable for the future of banking and lending.

Tags : fintech, importance of lendtech, Lendtech