LendTech: The Future of Borrowing Explained

LendTech: The Future of Borrowing Explained

You will be surprised to know that almost 9 in 10 Americans turn to FinTech apps for their financial needs. As a consequence, LendTech has swiftly become the go-to solution for seeking loans. It optimizes consumers’ qualifications, time, and money to get funds or loans. Ultimately, it eliminates the need for brick-and-mortar banks.

Today, we are going to explore how LendTech is reshaping the borrowing market.

What is LendTech?

LendTech is short for lending technology. It represents a seamless approach to providing financial services and loads. For that, it goes through the strategic integration of innovation. This transformative paradigm has revolutionized the landscape of borrowing.

The evolution of LendTech has refined the borrowing process. It introduces a paradigm shift that emphasizes simplicity, affordability, and speed. This is how it ensures a better experience for both companies and borrowers.

In recent times, LendTech has become a formidable disruptor in the financial sector. It introduces innovative business models and cutting-edge technology. So, it can challenge conventional banks and lenders now.

As per Statista’s projections, around 65.3% of US citizens are anticipated to do digital banking by 2022. In addition, the report highlights a noteworthy statistic. It indicates that FinTech companies have already facilitated 38% of personal loans. Therefore, the LendTech market is significantly growing in the financial landscape.

Types of Lending

The lending business has seen a substantial transformation. The rise of FinTech companies has fostered this transformation. In addition to traditional lenders, numerous alternative lenders have gained prominence. As a result, money borrowers have more options than ever.

The following are the notable types of lending among many options.

- Peer-to-peer (P2P) Lenders

This type of platform facilitates a direct connection between borrowers and investors. Primarily, this type of lending platform operates online. It has revolutionized the lending experience by eliminating the need for physical appearance. It creates a more direct and decentralized approach to lending.

- Crowdfunding Contributors

Think of it as a collaborative lending model. Here, individuals in need of financial support connect with a group of contributors. Crowdfunding may draw support from numerous sources. These include family members, friends, investment groups, and so on. This is a democratized approach to getting funding. The main purpose is to raise capital for specific business ventures.

The Current Situation of LendTech in Bangladesh Market

Bangladesh has yet to see much improvement in terms of LenTech. Some financial institutes are trying to initiate LendTech to the fullest extent. But the number of such institutes is very low. Perhaps companies that work with fintech can come forward to promote lendtech.

In August, Nagad surrendered its NBFI license. The reason was to apply for a digital bank license. On October 22, 2023, Bangladesh Bank issued letters of intent to 2 banks. They are Nagad Digital Bank and Kori Digital Bank. This decision can greatly expand people’s access to finance.

To fulfill the financial aspirations of the Bangladeshi people, Nagad’s digital bank can become a key player. The Managing Director of Nagad stated, “Nagad aims to bring millions of unbanked individuals into the financial fold and play a key role in achieving a ‘Smart Bangladesh.'”

However, it doesn’t fully open the windows for digital banking in Bangladesh. So, apart from Nagad and Kori, Bangladesh Bank also approved three bank-led applicants. These include:

- Digital – Lead by Bank Asia

- bKash Digital Bank – Lead by Brac Bank

- Digi10 – Lead by a consortium of 10 private banks

It is worth noting that all these 3 applicants possess full-fledged banking licenses. This decision is expected to contribute to the broader accessibility of digital banking services. Hopefully, this can be the first step in doing something bigger with LendTech.

Other than digital banking, several Bangladeshi startups have introduced the idea of lending technology. Starting with ShopUP, a lendtech company that provides financial services to small and medium-sized enterprises (SMEs) in Bangladesh. They use a combination of technology and data to assess creditworthiness and provide loans to SMEs that would otherwise be underserved by traditional banks.

Also, WeGro Global is an agri-fintech startup that utilizes technology to provide access to finance to smallholder farmers. Providing them with the working capital they need to initiate their ventures. And in total they’ve financed to 472M+ BDT worth of farming Projects.

It is expected that Lendtech will operate aggressively in Bangladesh soon.

Learn more about Fintech and its subdomains

What is India doing at Lendtech?

The lending sector in India is expanding. It is because of the collaborations between Fintech and traditional finance. These efforts were facilitated by initiatives from the government and the RBI. NPCIs like India Stack also played a vital role in this. The aim is to foster financial inclusion by encouraging the use of open APIs for gaining consumer insights.

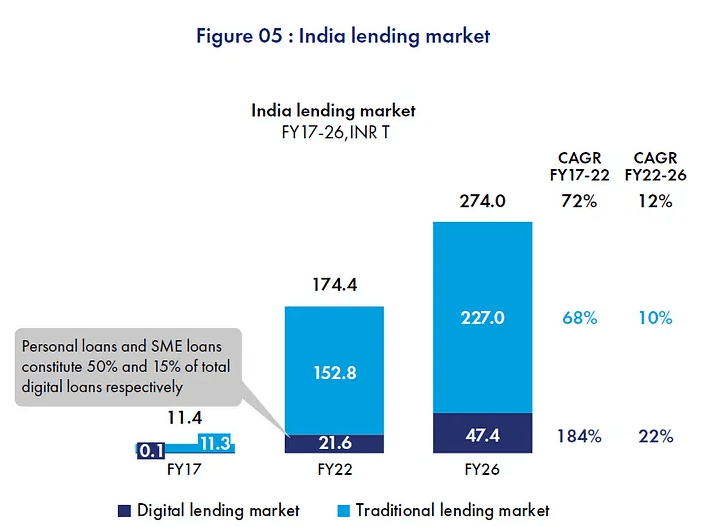

A report by Praxis Global Alliance highlighted that the Indian lending market reached a substantial size of INR 174 trillion. In terms of US currency, this is nearly $2 trillion. And they reached this milestone in the first quarter of 2022. Within this, the digital lending market is estimated at $270 billion. It is projected to grow at a robust CAGR of 22%. Hopefully, it will reach approximately $592 billion by the end of 2026.

Furthermore, the RBI has undertaken crucial regulatory initiatives. On September 2, 2022, guidelines were issued for Digital Lending. In addition, on August 10, 2022, a regulatory framework for Buy Now Pay Later (BNPL) was proposed. This framework outlined governance standards, consumer protection measures, eligibility criteria, and more. These regulatory steps are shaping a robust future for LendTech in India.

How Are We Doing Compared to the US in Terms of LendTech?

If you have read the above discussion, then it is clear to you that we are still far behind the US and other developed countries regarding LendTech. We should all come forward to focus more on this topic. If we have utilized the importance of FinTech, we should give LendTech a chance.

Even our neighboring country, India, is doing its best to take this technology to the next level. And they have shown significant improvement in this. We should also do the same. Otherwise, our financial sector won’t thrive. We should analyze the top LendTech companies in the US. We should learn about their movement and see how they are progressing.

On that note, we have listed the best companies that are doing great at LendTech. Let’s take a look.

The Top Players in LendTech

There are many LendTech companies around the world. Additionally, more are being introduced every day. Let’s explore the best LendTech companies that are leading right now.

- Credit Karma

This company offers insights on credit scores to its members. Plus, it provides recommendations for financially savvy decisions. The members make purchases based on Credit Karma’s suggestions. Then it receives compensation from banks and lenders.

- Affirm

The company enables users to shop and repay purchases on personalized terms. It doesn’t charge any additional fees. Affirm is dedicated to offering honest financial products.

- SoFi

It provides a diverse range of financial products. The members can achieve personal financial goals through saving and investing. They can also create customized financial plans.

- Auxmoney

It operates as a peer-to-peer online lending platform. It connects private and institutional investors with pre-approved borrowers. Auxmoney enhances credit access through innovative risk models and digital processes.

- Lending Club

It operates as a digital marketplace bank. Like SoFi, it offers its members a variety of financial products and services. The platform’s goal is to help users pay less when borrowing and earn more while saving.

- UpStart

It is a leading AI (Artificial Intelligence) lending platform. It focuses on improving consumer access to affordable credit. Simultaneously, it reduces lending costs for bank partners. This is how it enables higher approval rates with lower loss rates.

- Kabbage

The company offers direct funding to small businesses and consumers. For that, it uses an automated lending platform. It streamlines the lending process to support entrepreneurs.

Learn more about Fintech and its subdomains

What Benefits Do LendTech Companies Receive?

You can characterize FinTech lending applications with enhanced accuracy, better processes, and improved transparency. The innovation of these applications has unleashed a new era of lending. FinTech lending services can now offer a seamless virtual experience to their customers. It is all thanks to the integration of P2P platforms.

Notably, the small business credit market is a major beneficiary of FinTech lending. Conventional lenders often rely on a multitude of factors. They inspect credit scores, liquidity, and tax returns. In contrast, FinTech lending apps utilize AI and data to conduct a real-time analysis. It presents novel opportunities for businesses that were previously inaccessible. No doubt, this is a brilliant approach.

LendTech companies heavily rely on data and open banking. This approach is a key benefit to such companies. By utilizing this information, lending apps can meticulously gather the exact financial patterns of the borrower. In return, lenders gain a more unbiased view of borrowers’ creditworthiness.

Are There Any Drawbacks for LendTech Companies?

Undeniably, FinTech’s personalized solutions have streamlined the loan application process. However, there are noteworthy drawbacks that warrant consideration. Recently, the Federal Reserve Bank of Philadelphia conducted a study. They revealed that the expeditious nature of FinTech lending carries inherent risks.

In particular, the risk is greater for conflicting treatments and fair lending violations. FinTech firms employed alternative data sources to assess credit applications. It raises questions regarding policies. Also, this practice can highlight the susceptibility to errors.

For decades, lenders have been utilizing consumer’s educational and occupational data. However, lenders never asked for such data in the traditional lending process. This deviation from conventional data sources introduces a layer of complexity. If it is handled incorrectly, it can lead to inaccuracies and privacy concerns.

Furthermore, the rapid pace of FinTech lending may exacerbate these problems without care. Fast decision rates can leave little room for careful verification and validation. Consequently, errors or oversights in the assessment process may increase.

Wrapping up

Securing a loan was once a difficult process. LendTech has transformed it into a seamless and efficient experience. It redefines our relationship with traditional banking. Arguably, this will become a driving force in the future of finance.