EKYC Solution

About

Introducing our revolutionary EKYC solution! Say goodbye to manual processes and hello to efficient customer verification. Streamline your customer verification process, meet regulatory requirements, and propel your business to new heights. Embrace the future with our seamless and secure EKYC solution. Our advanced technology offers:

+ Biometric authentication for enhanced security.

+ Cutting-edge document verification.

+ Intelligent data analytics for accurate and fast onboarding.

Features

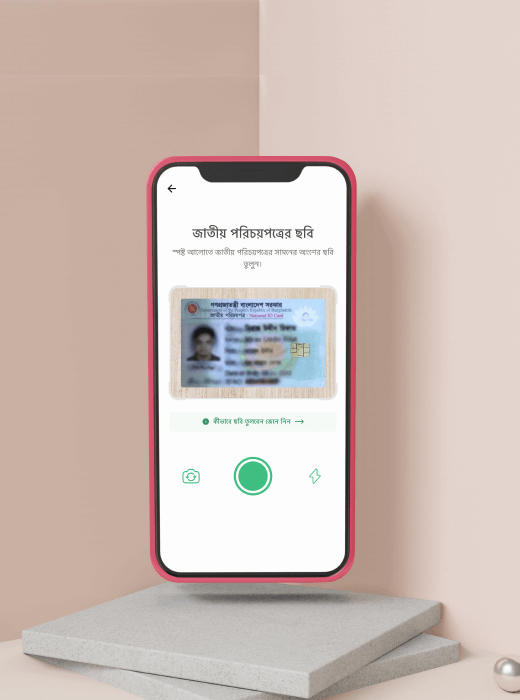

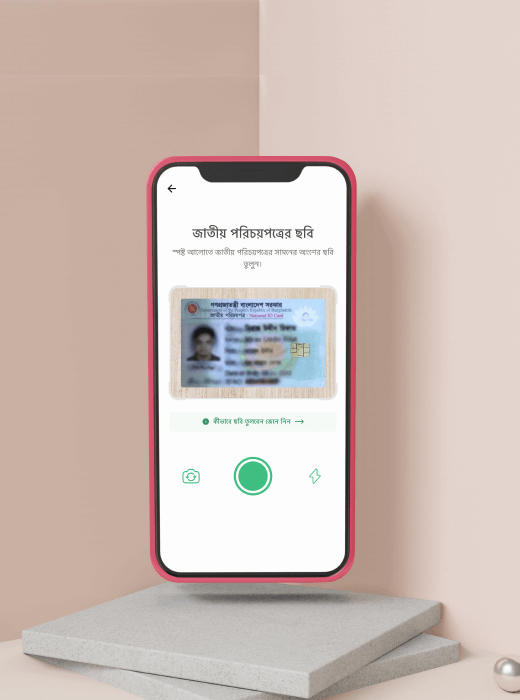

NID OCR

NID OCR, a pivotal EKYC solution feature. It swiftly extracts and processes vital data from National Identity Cards, ensuring seamless, accurate & secure user verification through advanced Optical Character Recognition and machine-learning technologies.

Administrative Portal

Simplified control: Manage EKYC operations effortlessly through our Administrative Portal. Streamline user verification, access real-time insights, and ensure compliance with an intuitive interface for efficient administrative oversight.

Data scraping from Election Commission

Using Robotic Process Automation and VPN, our eKYC extracts Election Commission data, improving accuracy in voter information integration, and strengthening identity authentication.

Matching System (EC Data VS OCR Data)

This feature performs rigorous cross-checks, aligning OCR-extracted details with Election Commission data. This meticulous match guarantees unmatched accuracy, elevating trust in identity verification processes.

Instant Verification

With our EKYC solution, no more waiting for physical documents! Customers can easily capture their IDs & complete verification in minutes. Say goodbye to paperwork & enjoy a faster process for all.

Liveliness Verification

Supercharge customer verification with Liveliness Verification in our EKYC solution. Eliminate fraud, enhance security, ensure compliance, and build trust.

Regulatory Compliance

Our EKYC solution ensures compliance by using up-to-date data from Bangladesh Bank to validate customer information in real time, meeting regulatory requirements effectively.

SDK For Andriod/Ios

Our EKYC solution offers versatile SDKs for Android and iOS platforms. Empower your applications with robust identity verification, leveraging the convenience and flexibility of mobile technology.

NID OCR

NID OCR, a pivotal EKYC solution feature. It swiftly extracts and processes vital data from National Identity Cards, ensuring seamless, accurate & secure user verification through advanced Optical Character Recognition and machine-learning technologies.

Administrative Portal

Simplified control: Manage EKYC operations effortlessly through our Administrative Portal. Streamline user verification, access real-time insights, and ensure compliance with an intuitive interface for efficient administrative oversight.

Data scraping from Election Commission

Using Robotic Process Automation and VPN, our eKYC extracts Election Commission data, improving accuracy in voter information integration, and strengthening identity authentication.

Matching System (EC Data VS OCR Data)

This feature performs rigorous cross-checks, aligning OCR-extracted details with Election Commission data. This meticulous match guarantees unmatched accuracy, elevating trust in identity verification processes.

Instant Verification

With our EKYC solution, no more waiting for physical documents! Customers can easily capture their IDs & complete verification in minutes. Say goodbye to paperwork & enjoy a faster process for all.

Liveliness Verification

Supercharge customer verification with Liveliness Verification in our EKYC solution. Eliminate fraud, enhance security, ensure compliance, and build trust.

Regulatory Compliance

Our EKYC solution ensures compliance by using up-to-date data from Bangladesh Bank to validate customer information in real time, meeting regulatory requirements effectively.

SDK For Andriod/Ios

Our EKYC solution offers versatile SDKs for Android and iOS platforms. Empower your applications with robust identity verification, leveraging the convenience and flexibility of mobile technology.

NID OCR

NID OCR, a pivotal EKYC solution feature. It swiftly extracts and processes vital data from National Identity Cards, ensuring seamless, accurate & secure user verification through advanced Optical Character Recognition and machine-learning technologies.

Administrative Portal

Simplified control: Manage EKYC operations effortlessly through our Administrative Portal. Streamline user verification, access real-time insights, and ensure compliance with an intuitive interface for efficient administrative oversight.

Data scraping from Election Commission

Using Robotic Process Automation and VPN, our eKYC extracts Election Commission data, improving accuracy in voter information integration, and strengthening identity authentication.

Matching System (EC Data VS OCR Data)

This feature performs rigorous cross-checks, aligning OCR-extracted details with Election Commission data. This meticulous match guarantees unmatched accuracy, elevating trust in identity verification processes.

Instant Verification

With our EKYC solution, no more waiting for physical documents! Customers can easily capture their IDs & complete verification in minutes. Say goodbye to paperwork & enjoy a faster process for all.

Liveliness Verification

Supercharge customer verification with Liveliness Verification in our EKYC solution. Eliminate fraud, enhance security, ensure compliance, and build trust.

Regulatory Compliance

Our EKYC solution ensures compliance by using up-to-date data from Bangladesh Bank to validate customer information in real time, meeting regulatory requirements effectively.

SDK For Andriod/Ios

Our EKYC solution offers versatile SDKs for Android and iOS platforms. Empower your applications with robust identity verification, leveraging the convenience and flexibility of mobile technology.

- Enhanced Customer Experience

- Scalability and

Integration

Additional Features

Our EKYC solution provides an enhanced customer experience with a user-friendly interface. It seamlessly integrates and scales with your existing systems, tailored to meet your industry's unique needs.

Additional Features

- Enhanced Customer Experience

- Scalability and

Integration

Our EKYC solution provides an enhanced customer experience with a user-friendly interface. It seamlessly integrates and scales with your existing systems, tailored to meet your industry’s unique needs.

Say goodbye to old-fashioned and inefficient customer onboarding methods. Step into the future with our advanced EKYC solution and discover a world of smooth operations, increased efficiency, and unbeatable customer happiness. Get in touch with us today to arrange a demonstration and witness firsthand how our solution can transform your business. Let's embark on a journey together toward effortless, secure, and compliant customer onboarding.

Industry GiantsWe Are Trusted By