Pocket eKYC Solution Implementation

Pocket by ABG Technologies

ABG Datafication Limited is a company of the esteemed Bashundhara group that has set its sights on leveraging the power of data to make informed decisions and transform the national ecosystem. However, their vision extends beyond personal gain. They are also committed to providing regular users access to the benefits of data through their ABG Datafication platform.

Challenges

Pocket, a payment service provider app by ABG Technologies, needed to automate its entire KYC process to reduce verification costs, boost productivity and efficiency, ensure compliance, and enhance customer experience and security measures. Other than Pocket, the Bashundhara group had multiple businesses where they needed to automate the KYC process, so they wanted to acquire an eKYC solution fit meet their needs.

Solution

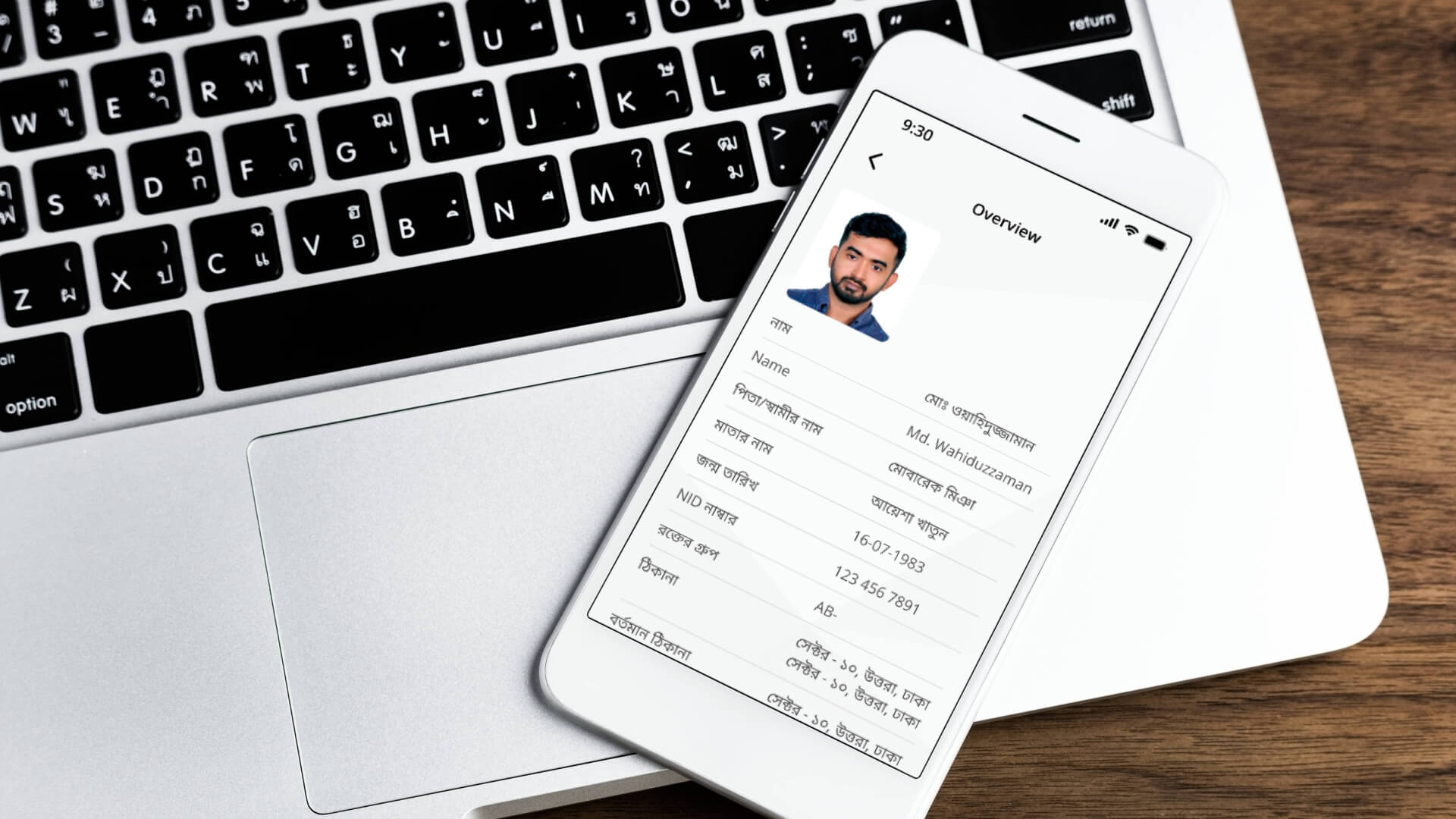

Polygon Technology successfully enabled ABG Datafication to implement Polygon EKYC, transforming their manual KYC process into a fully automated system. This integration benefits Pocket and other subsidiaries of the Bashundhara Group, allowing them to streamline KYC procedures, reduce operational costs, and automate workflows. By leveraging Polygon EKYC, these entities can ensure regulatory compliance, boost productivity, enhance user experience, and strengthen security in their verification processes.

Features

NID OCR API

Automatically detects and extracts text from images or documents containing NID cards. Supports multiple languages (e.g., Bengali and English) and ensures high accuracy in text recognition and extraction.Can integrate with other systems, such as KYC solutions or government databases.

Liveliness SDK

Ensures that the person being verified is a live human. Uses a camera feed to detect IRIS, eye movement, and facial movements in real time. Differentiates between live humans and still images or videos. Seamlessly integrates with other systems for efficient data exchange.

Election Commission Scraper

Automates the verification process using the Election Commission database. Logs into the EC portal with provided credentials, inputs NID and DOB data, and extracts relevant information.Saves the extracted data to a designated database and can send data to third-party systems if needed.

Matching System

Compares extracted OCR data with data from the Election Commission to verify identity. Generates a matching score by comparing name (in Bengali and English), DOB, parent names, spouse name (if any), address, blood group (if any), NID number, and face matching results.

NID OCR API

Automatically detects and extracts text from images or documents containing NID cards. Supports multiple languages (e.g., Bengali and English) and ensures high accuracy in text recognition and extraction.Can integrate with other systems, such as KYC solutions or government databases.

Liveliness SDK

Ensures that the person being verified is a live human. Uses a camera feed to detect IRIS, eye movement, and facial movements in real time. Differentiates between live humans and still images or videos. Seamlessly integrates with other systems for efficient data exchange.

Election Commission Scraper

Automates the verification process using the Election Commission database. Logs into the EC portal with provided credentials, inputs NID and DOB data, and extracts relevant information.Saves the extracted data to a designated database and can send data to third-party systems if needed.

Matching System

Compares extracted OCR data with data from the Election Commission to verify identity. Generates a matching score by comparing name (in Bengali and English), DOB, parent names, spouse name (if any), address, blood group (if any), NID number, and face matching results.

NID OCR API

Automatically detects and extracts text from images or documents containing NID cards. Supports multiple languages (e.g., Bengali and English) and ensures high accuracy in text recognition and extraction.Can integrate with other systems, such as KYC solutions or government databases.

Liveliness SDK

Ensures that the person being verified is a live human. Uses a camera feed to detect IRIS, eye movement, and facial movements in real time. Differentiates between live humans and still images or videos. Seamlessly integrates with other systems for efficient data exchange.

Election Commission Scraper

Automates the verification process using the Election Commission database. Logs into the EC portal with provided credentials, inputs NID and DOB data, and extracts relevant information.Saves the extracted data to a designated database and can send data to third-party systems if needed.

Matching System

Compares extracted OCR data with data from the Election Commission to verify identity. Generates a matching score by comparing name (in Bengali and English), DOB, parent names, spouse name (if any), address, blood group (if any), NID number, and face matching results.

- Online Payment

- Lab Order

- Appointment

Cancelling

Additional Features

The platform provides seamless management of appointments, enabling users to easily schedule, reschedule, or cancel their bookings. It also supports secure online payments for consultations and services, streamlining the transaction process. Additionally, patients can conveniently order lab tests directly through the system, simplifying their healthcare experience.

Additional Features

The platform provides seamless management of appointments, enabling users to easily schedule, reschedule, or cancel their bookings. It also supports secure online payments for consultations and services, streamlining the transaction process. Additionally, patients can conveniently order lab tests directly through the system, simplifying their healthcare experience.

Tech Stack

The Impact

The implementation of Polygon EKYC for ABG Datafication Limited has had a transformative impact across multiple sectors within the Bashundhara Group, including Pocket, their payment service provider app. By automating the KYC process. With Polygon EKYC, ABG Datafication significantly reduced operational costs and boosted productivity. The integration of advanced technologies ensured accurate user verification, enhanced security, and compliance with regulatory standards. This shift to an automated system not only streamlines workflows and reduces human error but also enhances the overall user experience and KYC operation better by making the verification process faster and more user-friendly.

The Impact

The launch of the Remit N Go app has resulted in increased profits for BRAC Saajan. Previously, their business relied heavily on agents, incurring significant commission costs. The in-house app now allows users to send money directly from their mobile devices, reducing the need for brick-and-mortar locations and agent commissions. This shift has not only cut costs but also enhanced user convenience, leading to higher overall profits for the company. Through the successful collaboration between BRAC Saajan Exchange and Polygon Technology, Remit N Go has transformed the remittance process, providing a user-friendly and efficient platform for the Bangladeshi community in the UK.

Håb (ハブ)

“Polygontech is helping startups like Håb to grow faster. With their supervision in product and expert engineers, our business growth accelerates at an outstanding level.”

Yohey Toyoda

Founder & CEO, Håb (ハブ)

Håb (ハブ)

“Polygontech is helping startups like Håb to grow faster. With their supervision in product and expert engineers, our business growth accelerates at an outstanding level.”

Yohey Toyoda

Founder & CEO, Håb (ハブ)

Solutions

we provide

With every single one of our clients we bring forth a deep passion for creative problem solving, innovations, forward thinking and proactive support to ensure the best possible service.

Build Your Tech Team

Build Your Tech Team Are you trying to build your tech team, ...

Software Maintenance Service

Software Maintenance Service Ensure the longevity and optimal performance of your software. ...

UI UX Design Service

UI UX Design Service Unlock the potential of your product with UI ...

Software Development Service

Software Development Service Accelerate disruption both within your organizations and industries. Bring ...

IT Staff Augmentation Service

IT Staff Augmentation Service Get Word Class Tech Talents From All Tech ...